Contact

What is an Opportunity Zone?

Opportunity Zones are an economic development tool promoting investment in distressed communities through legislation enacted by the Federal Tax Cuts and Jobs Act of 2017. Communities have been designated as Opportunity Zones by the U.S. Department of Treasury, incentivizing investments in these distressed communities to better address local needs in areas such as business growth, improvements to housing, and improvements to infrastructure.

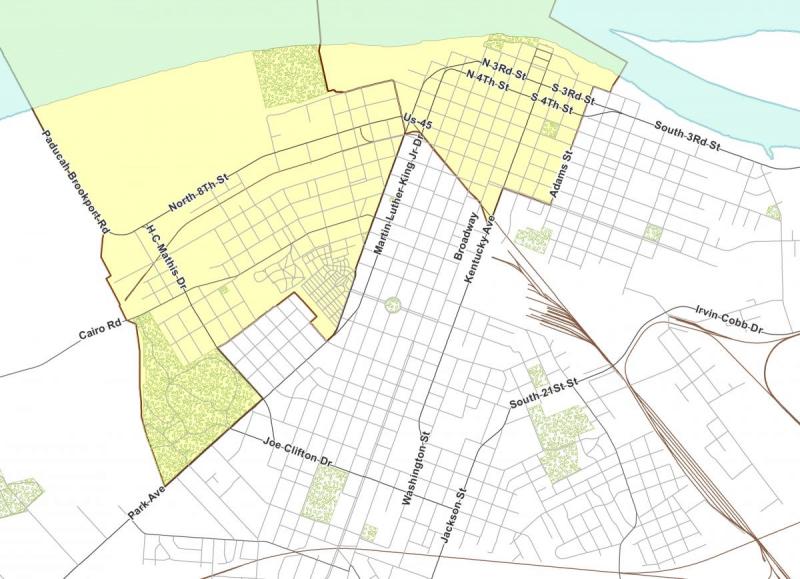

While Paducah is filled with opportunity, Kentucky's governor selected two census tracts (pictured) located along the Ohio River as our official Opportunity Zones.

What is the Opportunity? U.S. investors currently hold an estimated $2.3 trillion in unrealized capital gains. Opportunity Zones leverage this pool of money to promote economic development by providing federal capital gains tax advantages for investments made in these areas. Investors can realize deferral and reduction of capital gains taxes in investments held for at least five years with additional incentives available for investments maintained in Opportunity Zones for 7 and 10 years. To be eligible, investments must be made through Qualified Opportunity funds which are vehicles formed for investing in eligible Opportunity Zone property.

Capitalizing on the Opportunity in Paducah

Since time is of the essence, the City of Paducah partnered with Thomas P. Miller & Associates to execute a strategy to identify priority projects and market them to investors. Our strategy is as follows:

Since time is of the essence, the City of Paducah partnered with Thomas P. Miller & Associates to execute a strategy to identify priority projects and market them to investors. Our strategy is as follows:

- Evaluate current conditions in the Opportunity Zones to identify needs such as business, housing, and/or infrastructure.

- Create a well-articulated plan to achieve community development goals and investment needs.

- Adapt local development programs and incentives to make local Opportunity Zones more attractive to investors.

- Secure site control where possible increasing project readiness.

- Developing materials that effectively communicate investment opportunities to investors and Qualified Opportunity Fund managers.

Paducah is a thriving community! We want you to start your investment process as soon as possible. If you’re ready to get the discussion going, contact the Planning Department at 270-444-8690. The City's Team will take you through everything you need to know about our Opportunity Zones and the culture of our bustling community.

Why Does Paducah Need a Strategy?

There are thousands of Opportunity Zones throughout the United States; Kentucky has 144 zones in 84 counties. While each Opportunity Zone is eligible for the same tax advantages, all Zones are not created equal. It is estimated that there is over 2.3 trillion dollars in eligible capital gains eligible for investment – although only a percentage will actually be invested in Opportunity Zones. All Opportunity Zones will compete for investment, but some Zones will stand out immediately due to clear pro-investment market conditions. Paducah will likely be competing for investment with large MSAs (Metropolitan Statistical Areas) in the mid-west and south-east regions. Investors looking at Opportunity Zones may not consider or be aware of the advantages offered by Paducah’s Zones. Furthermore, potential local investors such as business owners may not know how to take advantage of Opportunity Zone incentives and the potential to assist with local expansion or capital investments.

Learn More about the Opportunities

Read Prospectus of Paducah Opportunity Zone Projects to learn about the opportunities.

Senior Policy Advisor Jason S. Rainey with the Kentucky Cabinet of Economic Development provided an overview of Kentucky’s Opportunity Zones and how the zones were selected in addition to how the program benefits Western Kentucky. View the presentation (recorded March 11, 2020) below: